Introduction: From Corporate Brands to Community Brands

Imagine launching a restaurant with such a staunch following that thousands of your fans come to support your opening day. That was the reality today for YouTube creator MrBeast, who launched a physical burger store and packed the second-largest shopping mall in America.

Fans of MrBeast filling the American Dream mall

Fans of MrBeast filling the American Dream mall

For those unfamiliar with business terminology, MrBeast’s burger store would be considered a direct-to-consumer (D2C) brand because the business is selling its product to consumers without any middlemen. However, MrBeast has also experimented with a business-to-consumer (B2C) model, like when he sold burgers through ghost kitchens using platforms like Uber Eats for delivery. DTC is an extension of B2C brands, and the internet has made it possible for businesses to take advantage of these models simultaneously. We’ll refer to both models as “consumer brands” for simplicity.

Consumer brands have been undergoing a transition in the past decades. Behemoths like Amazon, Starbucks, and YouTube attract immense consumer engagement, but what actual connection do consumers have with these brands other than a relationship developed by carefully crafted rewards programs?

These companies don’t have a face or a personal connection with consumers. In contrast to corporate brands, creators have taken advantage of social media platforms to launch their consumer brands. Emma Chamberlain, Peter McKinnon, and Hank and John Green are YouTubers who have launched coffee brands. Many other YouTubers, most notably Kim Kardashian, have started fashion brands. Creators are using their reputation to create brands that give their audience another way to engage with them.

Rather than relying on corporate marketing or celebrity to launch a brand, what would it be like to launch one with consumers themselves? That’s precisely the promise of a blockchain-based brand. Let’s explore a business lifecycle by taking the example of a fictitious blockchain-based coffee company BeanBit to understand how blockchain technology can grow an audience while aligning community and business incentives.

Introduction Stage

The introduction stage is the first stage in the business lifecycle in which a business tries to gain an audience in its market. Blockchain-based brands have been very successful in quickly building a large community and treasury. There’s the case of ConstitutionDAO, which raised 47 million dollars worth of ether to bid on an original copy of the U.S. Constitution. There are also the much-maligned ICO scams and low-effort NFT projects that have taken advantage of well-intentioned investors.

Regardless of the intentions of these individual communities, the architecture of a blockchain has made it easier than ever to quickly raise funding and gain an audience. A blockchain-based brand typically starts with a core group of members with a mission and roadmap who are willing to invest their time and money into building the brand’s infrastructure. In the case of our fictitious company BeanBit, the core members have the mission of creating the ultimate digital coffee brand. They may decide to create a multi-signature wallet, which allows the core members to collaboratively manage a treasury and make purchasing decisions based on a quorum.

The BeanBit founders may work on generating an audience through Twitter and ultimately funnel new members into Discord or Telegram to join community discussions and initiatives. Some communities gate access to their Discord by requiring a purchase before joining, which generates a feeling of exclusivity. For example, the “Crypto Packaged” Goods DAO requires an NFT purchase before joining their community. The current price for their most exclusive NFTs is around 10 ETH, which is currently around $15,000. Consumers are clearly willing to pay a high premium to have access to the resources within certain communities.

In the BeanBit community’s Discord, members discuss how to drive revenue to their treasury. To be truly sustainable, the community will need to find a way to financially incentivize members to invest their time and skills in building the business. One way that DAOs may initially drive revenue is to raise funding via investors in exchange for equity. DAOs may also choose to sell NFTs, products, or tokens.

The BeanBit community decides to sell coffee subscriptions via NFTs. The coffee subscriptions can be purchased using a smart contract that the core team has deployed to the Ethereum blockchain. Consumers will have to use a digital wallet to interact with the smart contract and their wallet addresses will be recorded as buyers on the smart contract. Some buyers may be enticed by the idea of a potential reward for buying the coffee subscription. For example, the architecture of a blockchain allows anyone to create a token with a particular value that can be exchanged for different currencies through decentralized exchanges like Uniswap. When these tokens are used to reward wallets that interacted with a smart contract they’re called “airdrops,” and can be delivered even without a community member expecting to receive one.

Now that the BeanBit community is generating revenue and members, it will have to focus on the challenge of growing as a digital-native company with members who may or may not know one another.

Growth Stage

At this point, a community may have launched a revenue-generating product and has a strong social media presence to attract new members and buyers. The community may even have funds to bankroll new initiatives to invest in its own growth. If it’s particularly successful, the community may start to attract partners. For example, Nouns DAO has built a brand successful enough to partner with companies like Bud Light and Brave. These companies recognize the power of the Noun DAO community, which is an NFT-gated community with a current minimum floor price of 29 ETH (~$45,000). In our case, BeanBit may decide to partner with coffee equipment brands to sell custom brewing equipment.

Blockchain communities have also been successful in holding physical events. The Bored Ape Yacht Club holds an annual festival in NYC called ApeFest with well-known performers like Eminem and Future. Sometimes the physical aspect of a blockchain community may be a particular real estate asset. The community build_republic aims to crowdfund real estate to generate revenue and as a benefit for its members. BeanBit may decide to crowdfund a coffee shop to generate revenue. In fact, TheCaféDAO is currently working on this.

Maturity Stage

What does maturity even look like for a blockchain-based brand? Maybe it’s the ability to hire a full-time staff, generate multiple revenue streams, or reach a million dollars in market cap. The novelty of these communities makes it challenging to create benchmarks for success. Perhaps we can try to draw a parallel between these communities and a cooperative business structure, which also aims to be a user-owned and controlled business.

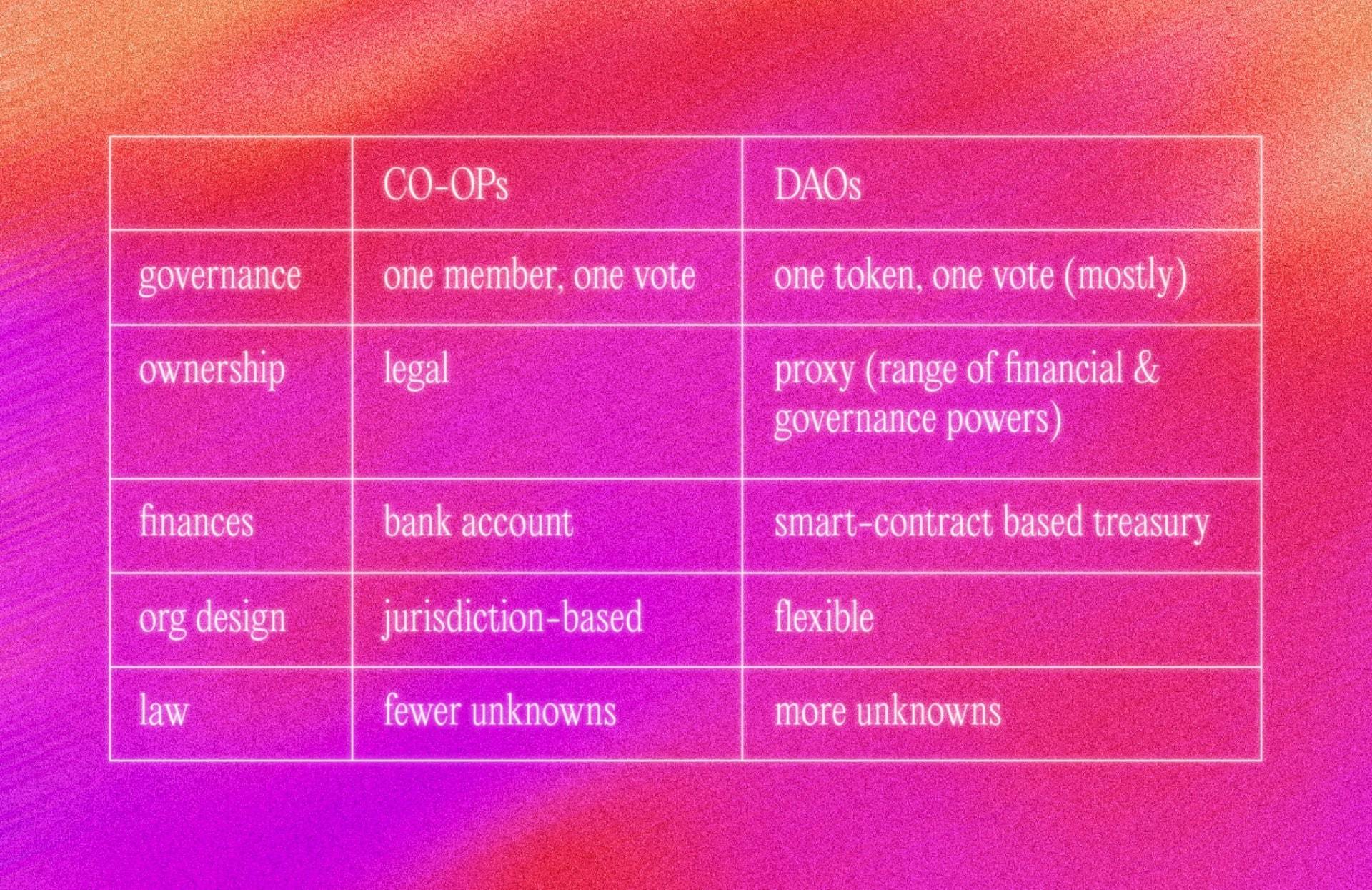

A comparison between a cooperative and a DAO created by Friends With Benefits

One of the most successful cooperatives in the world is the Mondragon Corporation, which is a corporation in the Basque region of Spain that employs over 80,000 employees. The cooperative had modest beginnings. It started with a Catholic priest opening a technical college in 1941, and the company continued to establish new cooperatives and grow on an international scale.

Like the Mondragon Corporation, it could be that a blockchain-based brand’s success may depend on its ability to build new revenue-generating niches. After all, a community may have little incentive to keep building a brand that sees little growth. Though, there’s still the question of who should take charge of scaling up a blockchain-based business. Noam Chomsky criticized Mondragon for being worker-owned but not worker-managed. How should accountability work in a digital-native organization with no real expectation of an organizational hierarchy?

Regardless of how we may define maturity, blockchain-based brands have generated an incredible amount of revenue, even though they may not be known to communities who aren’t as digitally savvy. The largest DAO token by market cap is currently Uniswap, which boasts a cool 5 billion dollar market cap according to CoinMarketCap. Uniswap is a decentralized cryptocurrency exchange that facilitates trading between tokens. Even many blockchain-savvy consumers may be surprised to hear that Uniswap is partly governed by a DAO and has such a large market cap. DAOs with large market caps like Uniswap and Aave demonstrate the variance in types of communities that can be tokenized. These two companies also demonstrate how a community can be generated from successful projects rather than the reverse.

Nine of the ten largest DAO tokens by market cap listed by CoinMarketCap are successful decentralized finance products that have generated a community. However, consumer brands may soon rival the size of these DAOs, though growth through physical products will take longer than generating revenue through Defi products. The second largest DAO token by token size is ApeCoin, which is Bored Ape Yacht Club’s token. The token generates its value by allowing governance participation and giving token holders access to merchandise, events, and other benefits.

Blockers to Building Blockchain Brands

The most common organizational structure for a blockchain business is a Decentralized Autonomous Organization (DAO). The legal and operational standards for these types of businesses remain a grey area. States like Vermont and Wyoming have attempted to create a legal wrapper for DAOs, but these structures are more similar than they are different from an LLC. This year the venture capital firm a16z published a comprehensive guide on legal wrappers for DAOs. Reading the guide, it quickly becomes apparent how fraught with decisions it can be to choose the proper legal wrapper(s).

The operational challenges for DAOs are just as pressing as the legal ones. DAOs operate differently from a traditional business and there’s no best practice handbook for operating one. DAOs all have their own opinions on decentralization, and this affects whether a DAO is truly owned by its members or by a core team and investors.

What’s Next for Blockchain Brands?

Blockchain brands have drastically different missions, legal structures, and ways of operating. They may operate without clear legal guidance and blur the line between a community and a business. It remains to be seen whether existing blockchain-based consumer brands like the Bored Ape Yacht Club and the Noun Project can overcome the scalability challenges of a blockchain business and continue to find new streams of revenue. In any case, blockchain technology has proven itself to be a novel opportunity for a new era of digital-native businesses.